Please turn on JavaScript in your browser

- Deposit Check At Atm Bank Of America

- Tcf Deposit Check At Atm

- Pnc Atm Check Deposit Limit

- Deposit Check At Atm Machine Chase

- Deposit Check At Atm At Chase Bank

- Deposit Check At Atm Navy Federal

- Can I Deposit Check Atm

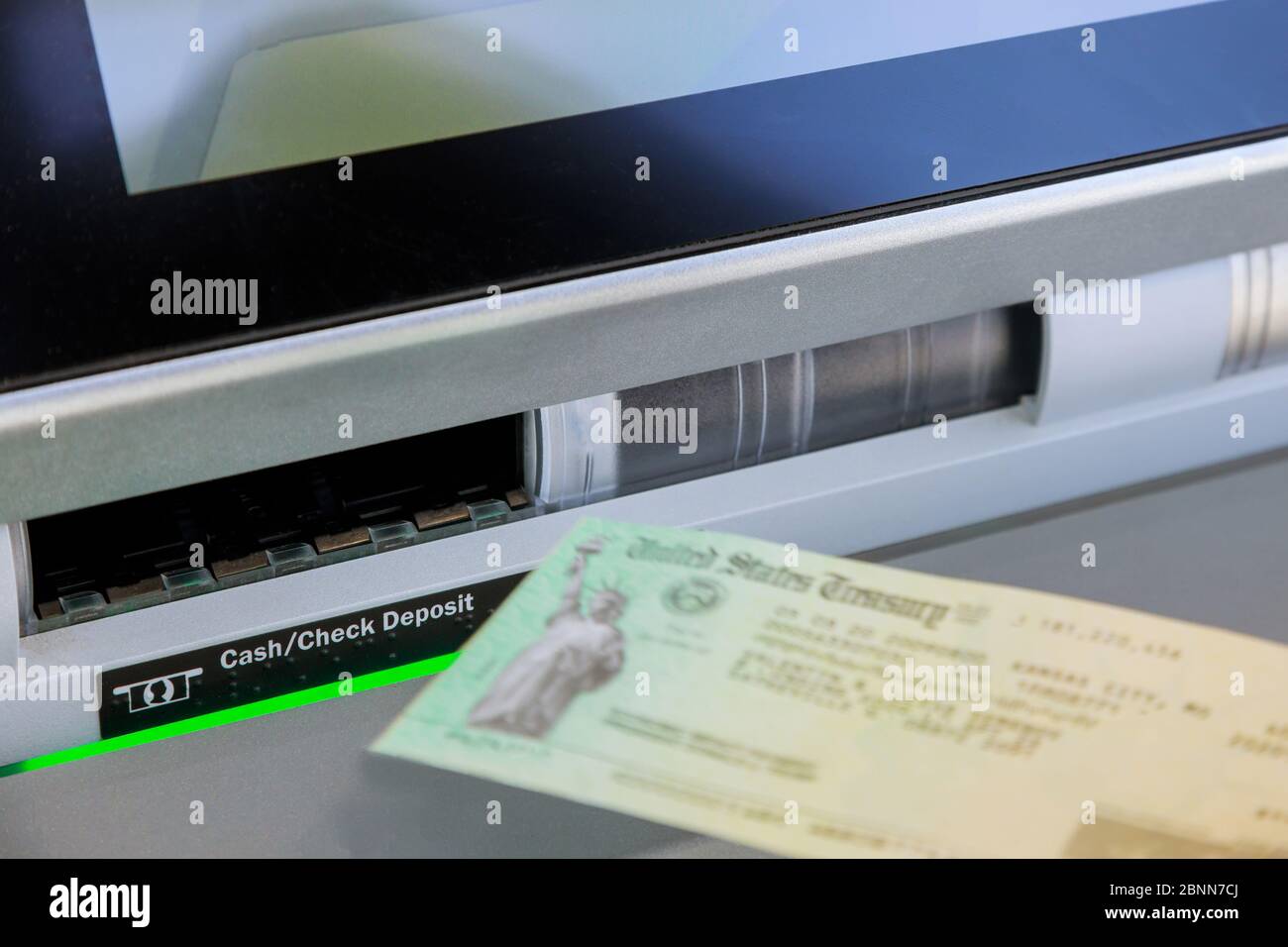

If you’re in a different neighborhood or out of town, you may still be able to deposit checks in an ATM. First, make sure the ATM takes your type of bank card and that it accepts deposits. Smaller ATMs located in convenience stores, for instance, may only dispense cash, so check for a deposit slot. “If you must use an ATM and it goes awry, note the time of the failed deposit,” says Gilbert, a Los Angeles-based musician who recently tried depositing a check worth about $1,000.

It appears your web browser is not using JavaScript. Without it, some pages won't work properly. Please adjust the settings in your browser to make sure JavaScript is turned on.

Manage your Chase ATM experience

- Chase ATMs — Conveniently deposit up to 30 checks and cash at most ATMs. Direct deposit — Automatically deposit paychecks. Pay bills quickly & conveniently. Online Bill Pay — Pay rent, mortgage, utilities, credit cards, auto and other bills.

- Nov 13, 2020 Just make sure you have enough money in your account to cover the check if the funds are not immediately available. Wells Fargo might not make these funds available immediately when you deposit a third-party check. Request an Increase. Request an ATM limit increase by calling Wells Fargo or visiting a branch and speaking with a banker.

Chase ATMs work with your mobile wallet

- Overview

- ATM Enhancements

- FAQs

Get cash at select Chase ATMs

Manage your money and your accounts at over 16,000 ATMs.

Deposit Check At Atm Bank Of America

Skip the lines and pay your Chase credit card, mortgage or home equity bill with cash or directly from your Chase checking or savings account.

Watch video about paying Chase cards at select ATMs

Choose your account, amount and receipt options in the Chase Mobile app® then stop by any Chase ATM to complete your transaction.

Tcf Deposit Check At Atm

Watch video about scheduling withdrawal

Set your preferences and customize your experience while at the ATM. Select which accounts to display, receipt options, Quick cash amount, and preferred bill denominations under the preferences tab.

Watch video about personalizing the ATM experience

See how-to videos for ATM banking

No debit card? No problem.

Now you can use your mobile wallet at Chase ATMs and get cash quickly and securely.

Q&A

Answers to the most common questions

How do I find the nearest ATM?

ExpandUse our locator to find an ATM or Chase branch.

Pnc Atm Check Deposit Limit

/https%3A%2F%2Fspecials-images.forbesimg.com%2Fimageserve%2F925786680%2F0x0.jpg%3FcropX1%3D0%26cropX2%3D3570%26cropY1%3D314%26cropY2%3D2695)

What is cardless ATM access?

Expand

Cardless ATM access allows customers to access Chase ATMs using an eligible Chase debit or Liquid card that has been loaded into an Apple Pay®, Google Pay™ or Samsung Pay mobile wallet. Once you have successfully loaded your card into your mobile wallet, you no longer need to have your physical card to make transactions at Chase ATMs.

Learn more about Cardless ATMs

Where are Chase ATMs with cardless access located?

ExpandCardless ATM access is currently available on Chase ATMs where you see this Cardless symbol:

How soon will my checks clear after depositing them at the ATM?

ExpandGenerally, for most accounts, you may withdraw funds the next business day after the business day you deposit them whether at the ATM or at a teller. But in some cases you may not be able to immediately withdraw or write checks against deposited funds. If funds from a deposit become Available and you can withdraw funds, that does not mean the check or other item you've deposited is Good has Cleared or has been paid by the paying bank. It's possible that the item will be returned unpaid months after we've made the funds available to you and you've withdrawn them. No one, including our employees, can guarantee you that a check or that or other item will not be returned. See the Product Disclosure Agreement for additional information.

Can I deposit checks 24/7?

ExpandYou can make check and cash deposits at virtually any Chase ATM 24 hours a day, 7 days a week. Use our locator to find an ATM or Chase branch.

How do I get assistance if I am depositing checks at an ATM after branch hours and need help?

ExpandPlease call the Chase Customer Service number that is printed on the ATMs.

Can I set up my personal preferences for the ATM?

Expand

ExpandYes, with Chase ATM QuickChoice®, Chase ATM's can save you time by remembering exactly how much money you usually like to withdraw, what language you prefer and if you want a receipt printed or sent to your email.

You can preset your:

- Language preference. Select the language you want to use for your future ATM visits and we'll remember it next time.

- Receipt preferences. Choose whether you want us to 'Always Print,' 'Never Print,' or 'Always Prompt' for a receipt.

See how to set your preferences

What is the maximum amount I can withdraw from an ATM using my debit card?

ExpandThere are daily dollar limits for ATM withdrawals that were provided to you when you received your Debit Card. If you have any questions, please contact us.

How many checks can I deposit at the ATM at one time?

ExpandConveniently deposit cash and up to 30 checks.

Deposit Check At Atm Machine Chase

What else can I do at the ATM?

Besides Depositing cash and checks and making withdrawals, you can also make transfers, view your balances, see your recent transactions and you will soon be able to make payments to your credit card.

Deposit Check At Atm At Chase Bank

Have more questions?

ExpandContact us or schedule a meeting with a banker.

Find a Chase ATM or branch near you

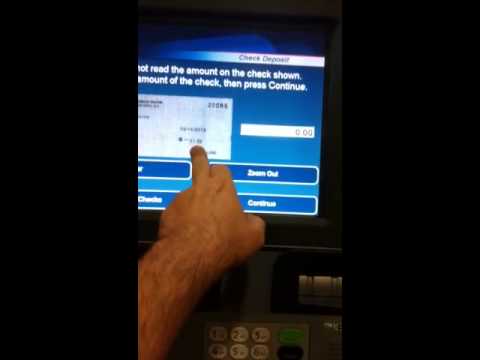

Depositing checks with your phone

- You can find the check deposit button in the navigation drawer of the Android app (tap Move Money, then Deposit a check).

- Tap that button, and you'll be guided through the process of submitting a deposit for review.

- Once the deposit is submitted, we'll review it and send you a support message.

- Swipe right to pull up the navigation menu.

- From there, tap Move Money.

- Tap Deposit a check and you'll be guided through the process of submitting a deposit for review.

- Once the deposit is submitted, we'll review it and send you a support message.

You can submit a check or money order with our iOS and Android apps. You'll see this option in the Move Money menu.

Things to keep in mind

- Whenever possible, submit your deposit before 5 p.m. ET (2 p.m. PT) on a business day. This ensures we'll be able to start processing it that day, making your funds available as quickly as possible.

- Since we'll be using your photo to create a legal copy of the deposit, make sure the image is clear and it includes all four corners of the deposit. Please don't write on the deposit or destroy it until we've confirmed it's been accepted.

- You can learn more about how a check or money order needs to be written and endorsed in the Deposit Requirements article.

How much can I deposit with Photo Check Deposit?

Your individual Photo Check Deposit limit can vary based on a few factors (like how long you've been with Simple, or how many checks you've deposited recently).

Deposit Check At Atm Navy Federal

To find out your current limit:

- Check the mobile app. From the Move Money tab, tap Deposit a check to show your current limit.

- Talk to us! We'll let you know your current limit.

If you have a large check (yay!) that's over your limit, you can deposit it by mail.

Can I Deposit Check Atm

When will my funds be available?

Generally, the funds will be available after 1 business day. If you submit a deposit before 5 p.m. ET (2 p.m. PT), we can start processing it that day. Accounts under 31 days old are subject to an extended hold of 9 business days.

You can get the full scoop in our article on check holds.